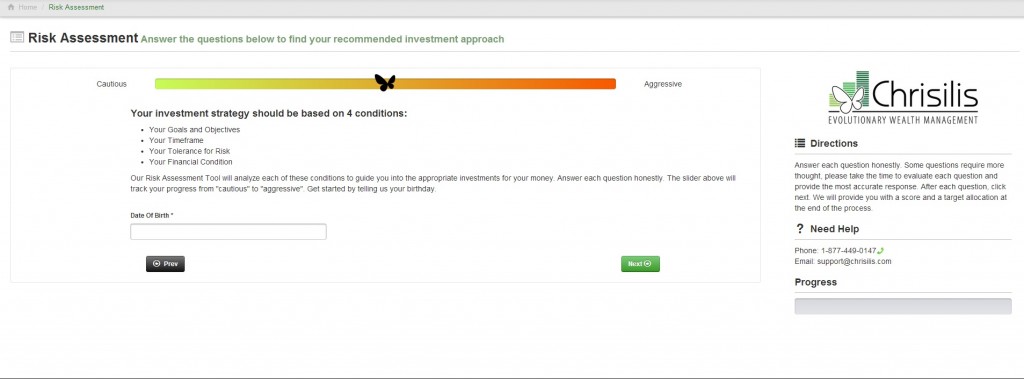

Investment portfolios should not be built on a hope or a hunch. They should be centered on 4 crucial factors:

- Financial Profile – simple profile data like age, income, and net worth start the foundation of a recommendation

- Time frame – Short vs. long-term directly impacts the amount of risk your portfolio can handle. Keep in mind, time is an investor’s best friend. With a longer time frame, the risk of volatile assets is reduced and an investor can be well compensated for their commitment to the investment

- Investment Objectives – Expectations and goals help formulate the financial tools and asset classes necessary to build your portfolio

- Risk Tolerance – the most objective of all aspects, an investor must seriously consider the potential gains, and more importantly, losses they can handle. You must attempt to predict your reactions to changes in the value in your investments

Chrisilis created a proprietary Risk Assessment tool to help you evaluate these 4 aspects of your financial plan. You can take our 5 minute online Risk Assessment and see how your risk score matches up to one of Chrisilis’ 5 investment portfolio allocations. We will continue to incorporate additional data, refine questions, and monitor investor behavior to create the most accurate representation of our clients’ risk tolerances and the corresponding investment portfolios.