6 INVESTMENT TENETS

All investment decisions will be driven from 6 core principles within our investment philosophy.

Chrisilis uses Exchange Traded Funds (ETFs) that replicate the performance of an index. We “own the market” rather than individual stocks or bonds.

All our portfolios have balance. This means your money is invested in “more than just stocks”. A complete portfolio includes assets like bonds, real estate, and commodities.

Beyond different asset classes, all portfolios include global exposure and optimize each component of the portfolios to include the greatest risk vs. reward potential.

We take a consistent approach not based on guessing which direction the market is headed next. History has proven this creates the greatest opportunity for success for all investors.

Your money is in trusted hands. Experts in investments with your interests at heart apply a consistent strategy to help you build wealth.

No one will care more about your money than you, but we are a close second. Your success means our success!

LOWER FEES

Our strategies begin by using ETFs with some of the lowest expense ratios in the industry. All the funds in our portfolio can be bought and sold without a hefty fee to the broker.

That means commission free trading!

Calculate Your Costs

LOWER TAXES

ETFs are some of the most tax efficient investments available. Our portfolios hold funds you can hold for a lifetime. That means very little portfolio turnover reducing short and long-term capital gains triggered by selling assets.

Finally, if possible, we guide you into the most appropriate account structure to utilize the tax deferred advantage in retirement accounts. Learn More

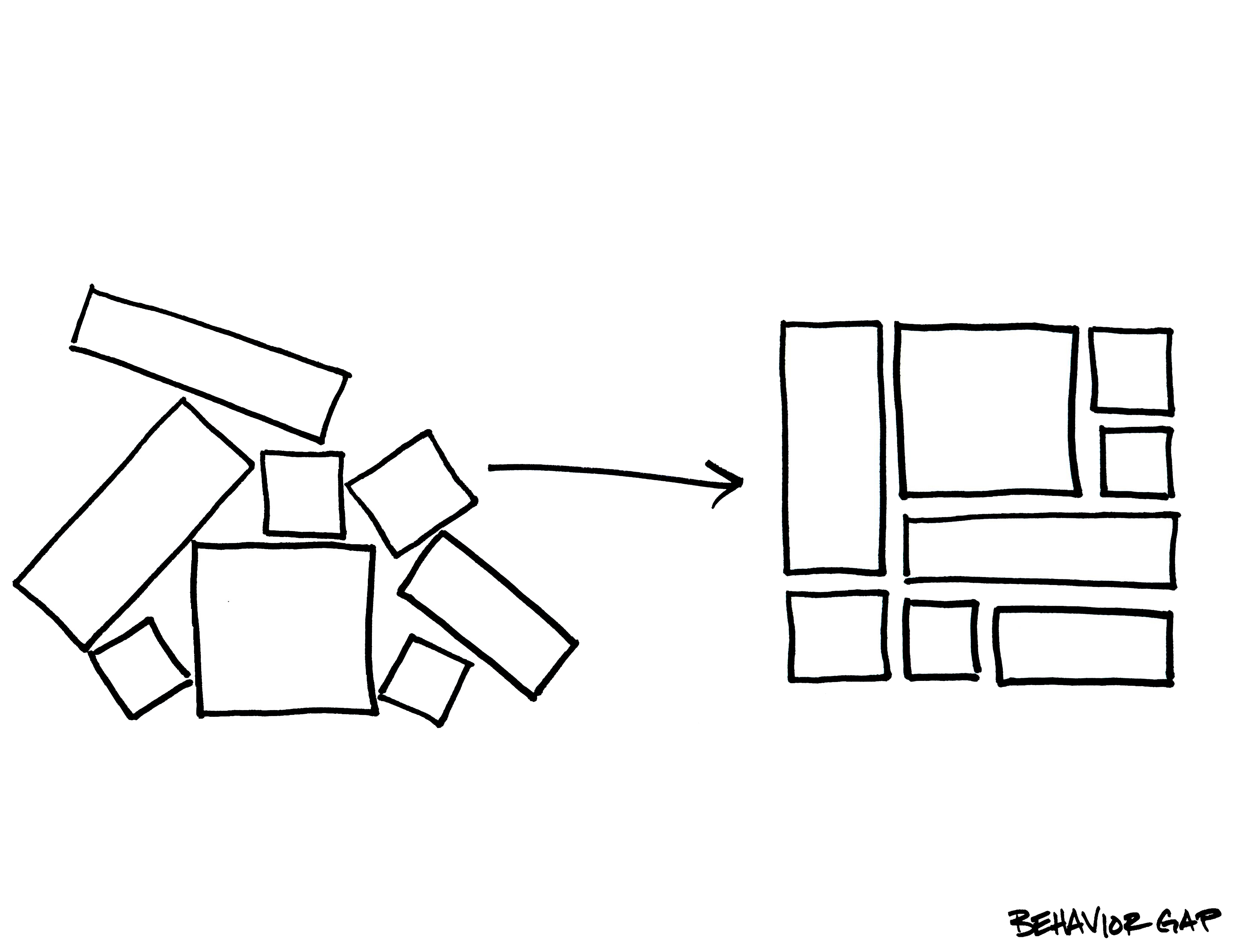

OWN THE MARKET: INDEXING

Index investing through Exchange Traded Funds (ETFs) means owning a basket of securities rather than picking individual stocks and bonds. Bad decisions by investors lead to below-average results. Professional money managers spend their careers researching securities and trying to beat the market. So far, no one has been successful. Owning the index is a simple way to replicate the performance of an asset class.

ASSET ALLOCATION

No one should put all their eggs in one basket. Each of our portfolios devotes a portion of your money into all the major investment choices. The percentage of money in each asset depends on your risk tolerance, time frame, and return requirements. The BALANCE in each portfolio creates more consistent returns and creates the best opportunity for you to achieve for long-term success.

Through the advancement of ETFs in recent years, individual investors can access nearly all asset classes at a very low cost. Unlike most advisors, our allocations go beyond stocks and bonds to include Real Estate, Commodities, and Emerging Markets.

DIVERSIFICATION

Each of the ETFs in our portfolio gives you ownership in 100s or even 1,000s of companies. We include multiple ETFs in some asset classes to further enhance the return and reduce your overall risk. First, that means including companies from around the world. Next, we overweight small companies over large because of their enhanced long-term return expectation.

Since not all these investments will move in the same direction at the same time, your portfolio is less likely to experience large swings in value. Also, when one investment performs poorly, other funds will react differently, avoiding steep declines in your portfolio’s value.

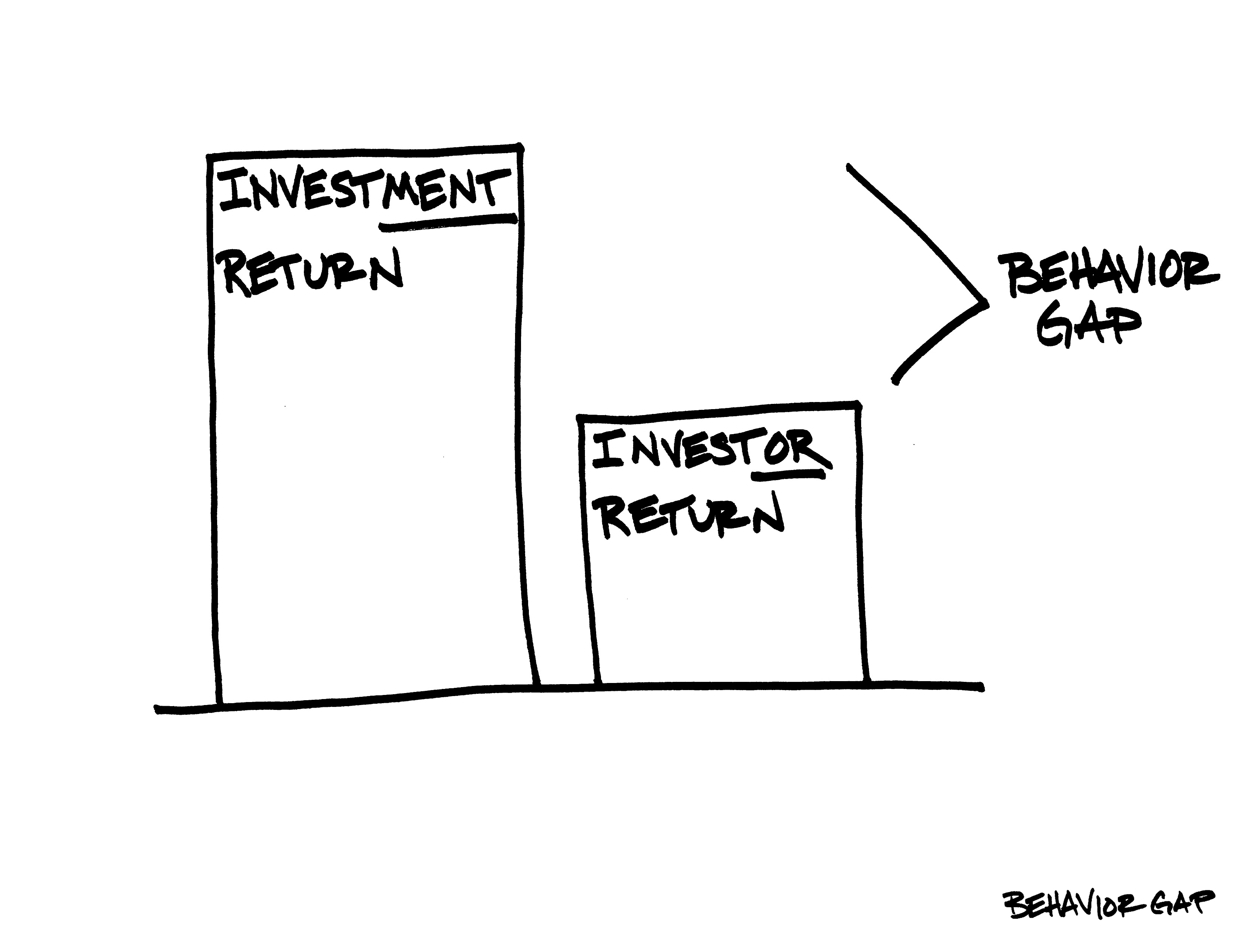

PASSIVE MANAGEMENT

Stock selection and market timing are a MYTH. No one has consistently only invested in stocks that go up in price. Investment professionals that watch the market every day cannot accurately time when to get in the market and when to sell before prices decline. These attempts at Active Management end in under-performance when measured over and extended time period. The SIMPLE solution is to buy an asset through ETFs, then utilize diversification and asset allocation to reduce the risk in your portfolio.

PROFESSIONALLY MANAGED AND MONITORED

Our expertise and experience translates into state-of-the art investment management and technology. You get rock solid advice, guidance, and management of your money on your way to wealth. Incorporating proven concepts in Modern Portfolio Theory and behavioral finance, the bulls and bears of the future will be no match for your money.

We must also mention, your account is monitored daily to keep your account within strict parameters of the optimal allocation. This includes automatic investment of your contributions, dividends, and interest as soon as they are received.

START TODAY

Enter your email and get access to our free wealth building mini course.